direct vs indirect cash flow gaap

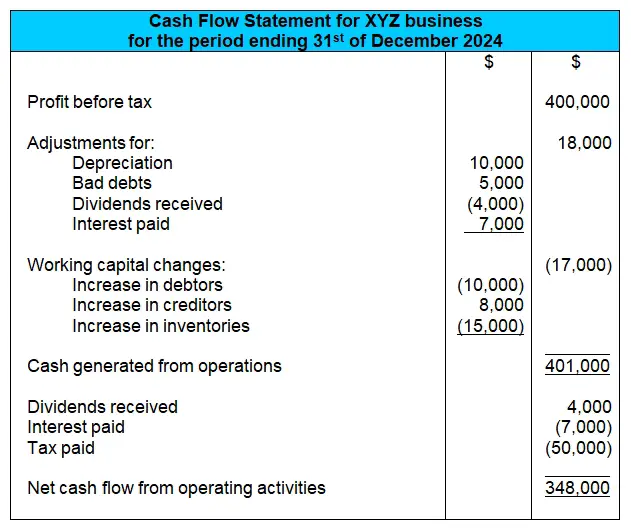

The indirect cash flow method makes it easier to report cash movements in and out of the business for accruals basis accounting. Cash flows from investing activities and cash flows from financing activities are the same for a.

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

As you can imagine the risk of mistakes on a direct cash flow statement is more significant than on a cash flow statement prepared using the indirect cash flow method.

. Its faster and better aligned with the way this. The indirect cash flow method starts with your organizations net income. Under the indirect method the calculation of cash flows.

95 permit the direct and the indirect method of reporting cash flows from operating activities. US GAAP shows bank overdrafts as financing activities. The investing and financing categories.

The indirect method backs into. It also allows for. As it focuses only on cash transactions that have been received or paid out the direct method offers a more transparent view of your cash flow.

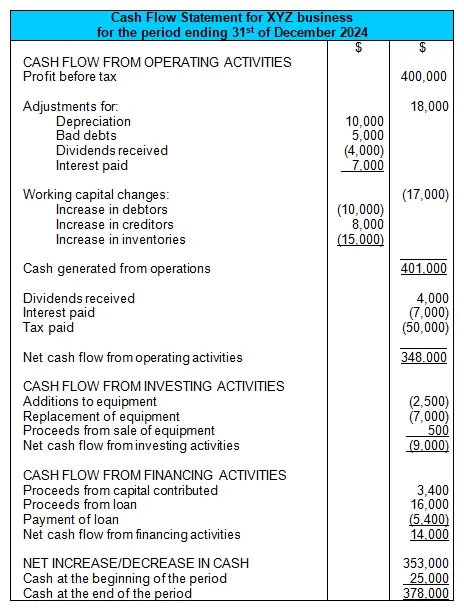

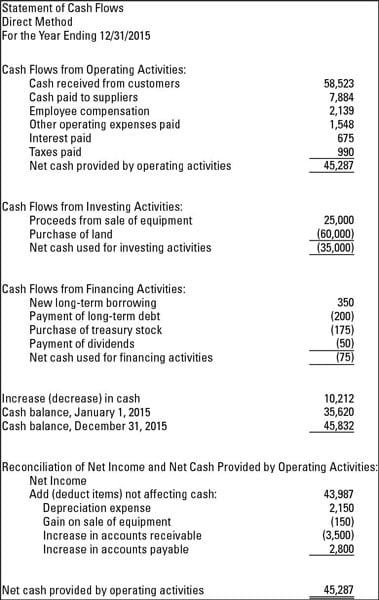

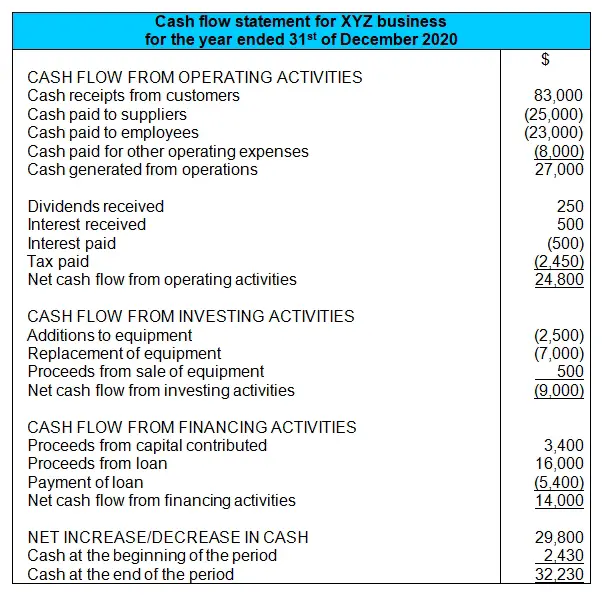

The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments. Up to 5 cash back IAS 7 and Section 230-10-45 FASB Statement No. Under the indirect method the cash flow statement begins with net income on an accrual basis and subsequently adds and subtracts non-cash items to reconcile to actual cash.

Operating investing aka discretionary and financing. The difference between these. Allowing companies to elect to present cash flows from operating activities using either the direct method showing receipts from customers payments to suppliers etc or indirect method.

Though the Financial Accounting Standards Board generally prefers the direct method statement of cash flow both the direct and indirect methods of cash flow are in line. Direct method vs indirect method The direct method provides information about specific sources and uses of. The Indirect Cash Flow Method.

Both the Direct and Indirect methods require that cash flows be classified into three categories. The UCA cash flow model has become a standard for the lending industry. Ad Learn the 6 Ways to Increase Your Bottom Line with Cogent Analytics.

It then makes adjustments to get to the cash flow from operating activities. The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. By contrast the indirect method shows only the net effect of items which caused net income and net operating cash flows to differ.

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

2022 Cfa Level I Exam Cfa Study Preparation

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

What Is The Difference Between The Direct And Indirect Cash Flow Statement Methods Universal Cpa Review

Direct Vs Indirect The Best Cash Flow Method Vena

The Indirect Cash Flow Statement Method

Methods For Preparing The Statement Of Cash Flows Dummies

Statement Of Cash Flows Direct Method Format Example Preparation

The Essential Guide To Direct And Indirect Cash Flow In 2022 Cash Flow Statement Cash Flow Positive Cash Flow

The Indirect Cash Flow Statement Method

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Statement Cash Flow Accounting Basics

Direct Vs Indirect Method Statement Of Cash Flows Youtube

Us Gaap Vs Ifrs Accounting Education Accounting Student Bookkeeping Business

The Indirect Cash Flow Statement Method

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Statement Of Cash Flows Indirect Method Format Example Preparation

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal